We in Washington state are blessed to be living in one of the wealthiest states in one of the wealthiest nations in the history of the world. Yet our State legislature remains in gridlock. They can not find the money to fully fund our public schools – even when ordered to do so by the Washington Supreme Court! As a consequence, our students are forced to endure some of the highest class sizes and lowest school funding in the nation – harming the future of our children, the future of our economy and the future of our democracy. According to the National Center for Education Statistics Schools and Staffing Survey (Table 8), Washington State has the third highest class sizes in the nation for elementary school, the second highest class sizes in the nation for middle school and the second highest class sizes in the nation for high school. http://nces.ed.gov/surveys/sass/tables/sass1112_2013314_t1s_007.asp

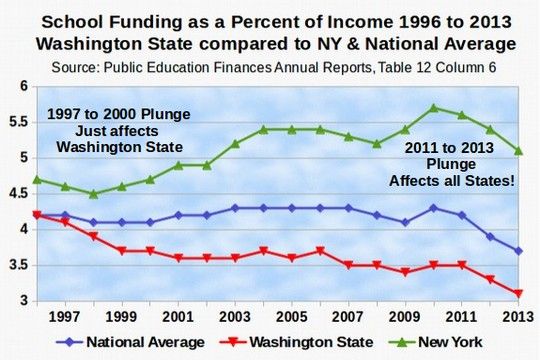

It hasn't always bee this way. In the 1980s, Washington state was 11th in the nation in school funding as a percent of income. In this article, we will review when and why school funding plunged here in Washington state. We will then explain why Senate Bill 6093 is a simple and fair solution to our ongoing school funding crisis.

1997 to 2015 18 Years of Billions in Tax Breaks for the Super Rich

Unfortunately, in the 1900s, the state legislature began passing billions of dollars in tax breaks for wealthy corporations. By 1997, school funding in Washington state fell to 25th in the nation. Then, as we explained in our last article, between 1997 to 2001 school funding in Washington state fell even more – to billions of dollars per year below the national average where it has remained ever since!

We can see from the above graph that the 1997 to 2001 plunge in school funding was caused by a problem in our state rather than a national problem – as national average school funding actually rose after 1997. But money never disappears. It is simply diverted from one place to another. So where did the billions of dollars that should have been spent on public schools go?

Follow the Money

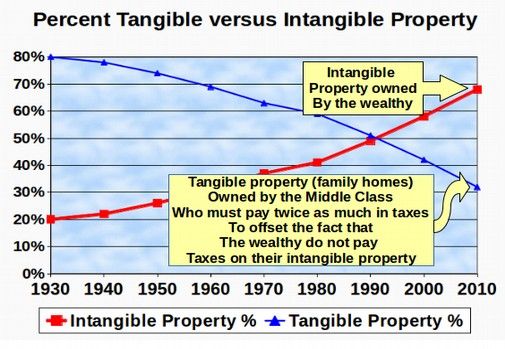

One important clue is that whatever happened to cause the plunge in school funding, it started in 1997. After some research on various large state tax breaks, it turns out that in 1997, the state legislature passed Senate Bill 5286 exempting all intangible property from our state property tax. Tangible property is property you can touch –such as homes and commercial buildings. Intangible property includes all other forms of wealth – such as stocks, bonds and computer programs. With the concentration of wealth in the hands of the very rich, the value of intangible property is now much greater than the value of tangible property.

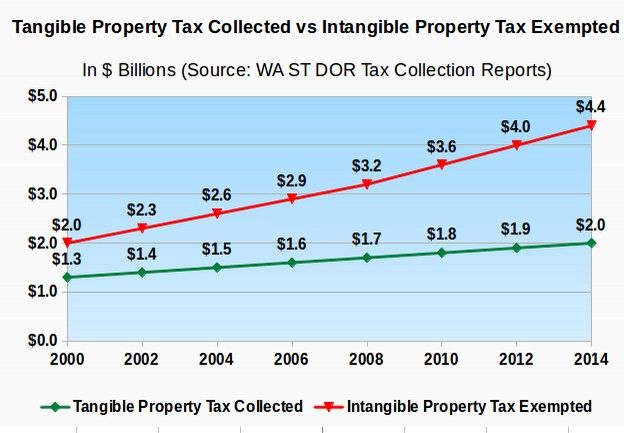

Historically, intangible property accounted for a very small percent of all property. However, with the concentration of wealth in the hands of the richest one percent, intangible property now account for over 70% of all property. Over 90% of intangible wealth is owned by the top one percent of our richest citizens. This massive 1997 tax loop hole has given billions of dollars in tax breaks to our richest citizens every year during the past 18 years by exempting over one trillion dollars of “intangible property” from our State property tax. It is the single largest tax break in the history of our state and bigger than the Billion Dollar Per Year Boeing Tax Break and the Billion Dollar Per Year Microsoft Tax Break combined!

According to the Washington State 2008 Tax Exemption Report, this intangible property tax exemption is the single largest tax exemption. In 2008, it was valued at nearly $4 billion annually. See 2008 Washington State Tax Exemption Report, Summary List. http://dor.wa.gov/docs/reports/2008/Tax_Exemptions_2008/Tax_exemptions_2008.pdf

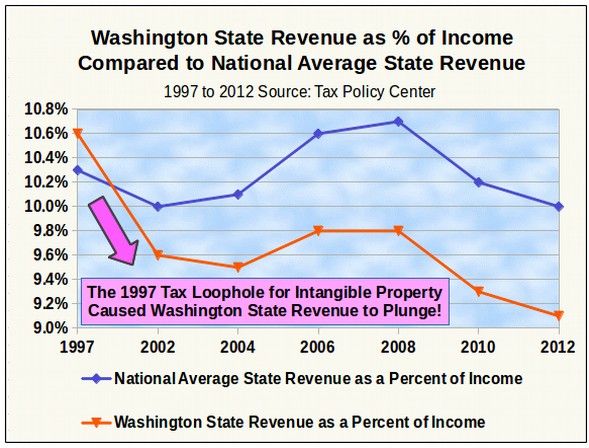

Currently, the Intangible property tax exemption is as much as $8 billion annually. By comparison, funding for our public schools for one million school children is also $8 billion annually. So we spend as much on this single tax break for the rich as we do on educating our state's one million school children. This tax breaks caused state revenue as a percent of income to plunge compared to the national average state income. http://www.taxpolicycenter.org/taxfacts/Content/PDF/dqs_table_77.pdf

While national average state revenue remained above 10% of income, state revenue in Washington state has fallen to only 9% of income. This does not sound like much of a difference – but it comes to $3 billion in revenue less per year! Source: Washington State Department of Revenue http://dor.wa.gov/docs/reports/2008/Compare06/Table3.pdf

A Billion Dollar Shift in Property Tax Burden from Investors to Homeowners

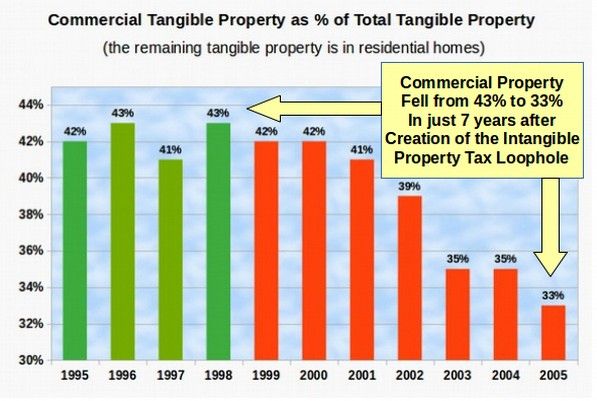

One mechanism that led to this loss of state revenue was that wealthy investors suddenly had a huge financial incentive to mis-classify their commercial tangible property as intangible property. This is what many investors did – causing a huge shift in property tax burden from investors to homeowners. Here is a graph of this shift:

Source: Washington State Department of Revenue http://dor.wa.gov/docs/reports/wa_tax_system_11_17_2004.pdf

The property tax burden on middle class homeowners has skyrocketed in the past 14 years as the ratio of commercial to residential tangible property has shifted from about 50-50 in 1997 to 66% residential to 33% commercial by 2006. When $100 billion dollars of commercial property is exempted from property taxes, residential property taxes must go up even if State and local spending remains the same.

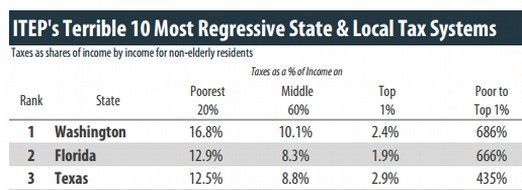

As a consequence of these tax break for millionaires, and tax shifts to our middle class, our middle class now pay much more than the national average in State taxes while millionaires in our State pay much less than the national average. Working families see their tax bills go through the roof and they naturally assume that State spending is “Out of control.” But what is really out of control is tax breaks for billionaires.

Because of all the tax breaks they get, billionaires now pay less than 3% of their income in State taxes. Meanwhile, our poor and middle class pay State taxes at a rate of 16% or more. We have allowed our State to become a tax haven for billionaires. Those who can afford to pay the most are paying the least. Meanwhile, those who can afford to pay the least pay the most. As a consequence of these tax breaks for billionaires, in just the past 10 years, the richest one percent have gone from owning 20% of our nation’s wealth to owning 40% of our wealth. http://www.itep.org/pdf/whopaysreport.pdf

Many Efforts to Restore School Funding Since the 1997 Plunge Have All Failed

The plunge in school funding since 1997 closely parallels a related plunge in State revenue. The loss of billions in state revenue caused school funding in our state to fall from above the national average to among the lowest in the nation. In response to the rapid decline in school funding in the late 1990's, voters passed Initiatives 728 and 732 trying to restore school funding in 2000. Unfortunately, the State legislature refused to honor these two Initiatives – preferring instead to continue the 1997 tax break for billionaires and grant billions of dollars in additional tax breaks to wealthy multinational corporations like Microsoft and Boeing.

This ongoing transfer of billions of dollars per year away from public schools to the pockets of billionaires led to the NEWS Coalition McCleary Lawsuit which began in 2005. The trial was in 2009. In 2010, the trail court agreed with the NEWS Coalition that the legislature was not complying with Article 9 Sections 1 and 2 of the Washington State Constitution. In 2012, the Washington State Supreme Court agreed with the trial court and ordered the State legislature to comply with our State Constitution and fully fund our public schools. Unfortunately, the State legislature ignored the 2012 order of our Supreme Court and continued with their billions in tax breaks for the wealthy.

On September 11, 2014, the Washington State Supreme Court for the first time in the history of our state found our State legislature in contempt of court for failure to comply with a 2012 Supreme Court order to fully fund our public schools. The Supreme Court gave the legislature a firm deadline until the end of the 2015 legislative session to comply with the court order. In addition, on November 4, 2014, the voters of Washington state passed Initiative 1351, the Class Size Initiative, which required the State legislature to restore school funding and class sizes in our state to at least the national average. Finally, in April and May 2015, teachers across Washington state began a series of rolling walkouts to protest the legislature's lack of funding for public schools

Sadly, instead of passing a bill to fully fund public schools, the 2015 legislature has once again kicked the can down the road by proposing to set up yet another in a long line of Education Funding Committees. This is not likely to satisfy the Supreme Court, the teachers or the voters. It is likely that the Supreme Court will be forced to take additional action in the coming months. It is also possible that teachers may launch a statewide strike in the fall to protest the lack of funding. In short, our state is about to face a Constitutional School Funding Crisis.

Senate Bill 6093... A Simple Solution to the School Funding Crisis

It does not have to be this way. All why need to do is roll back the 1997 tax break. This would not harm billionaires because they could still deduct their state taxes from their federal taxes. But it would restore billions of dollars per year to state revenue in order to increase school funding to the national average so we could lower class sizes down to the national average. Senate Bill 6093, sponsored by Senators Chase and McAuliffe, would provide an additional $4 billion per year to restore school funding and lower class sizes in our state to the national average by repealing this single 1997 tax exemption. Senate Bill 6093 is a fair and simple solution to the school funding crisis in Washington state which raises billions in state revenue without raising the tax burden on working class families and without requiring huge cuts in other essential state services. Senate Bill 6093 would repeal this huge tax break for the wealthy and invest $4 billion per year in public schools to restore school funding in our state and lower class sizes in our state back down to at least the national average.

Senate Bill 6093 would place a referendum before the voters asking to repeal the current exemption on intangible property from the State property tax and tax intangible property at the same one percent rate as tangible property. Retirement accounts and personal intangible property up to $200,000 not in retirement accounts would be exempt. So closing this tax loop hole would only increase taxes for the top 5% of our wealthiest citizens. The other 95% would see a reduction in their State taxes of as much as four thousand dollars per year!Here is a link to Senate Bill 6093 so you can read it for yourself:

http://lawfilesext.leg.wa.gov/biennium/2015-16/Pdf/Bills/Senate%20Bills/6093.pdf

Given that the current legislature continues to ignore the Supreme Court and ignore the will of the voters by continuing to kick the school funding can down the road, now is the time to begin a public discussion over the best way to balance the State budget while still protecting the future of our children and our communities. Funding our public schools should be more important than protecting tax breaks for billionaires. We hope parents and teachers will help us get this bill on the ballot. With the serious nature of our current school funding crisis, it is time to put all options on the table and begin a public discussion over the future of our schools and our State.

Regards,

David Spring M. Ed.

Director, Coalition to Protect our Public Schools

Spring for Schools (at) aol (dot) com